Preface – The Paradigm Shift to Online in Today’s Sourcing

Over the past two years, the ongoing pandemic has forced buyers and suppliers all over the world to adapt their sourcing practices. In our new normal of travel restrictions and social distancing, the disruption of the global supply chain, increasing freight costs, stock shortages and shipment delays have emerged as major challenges to sourcing.

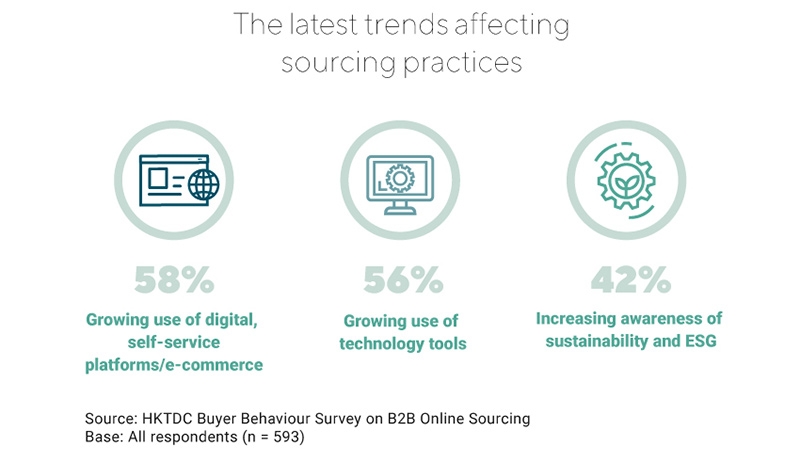

Sourcing workflows have been evolving to bypass these barriers. For buyers, the due diligence stage that used to take place primarily in‑person – namely pre‑sourcing research, supplier/product evaluation and selection – is now taking place online along with purchasing and post‑procurement stages. For suppliers, digital is fast becoming an essential part of conducting business with buyers’ growing usage of online self‑service platforms, e‑commerce, and technology tools such as video conferencing and instant messaging.

While a paradigm shift to online was already occurring prior to the pandemic, the progress of digital transformation has now become even more instrumental for buyers and suppliers. As digital tools establish themselves in this reshaped marketplace, companies are re‑evaluating the roles of physical fairs and virtual fairs, with the hybrid fair concept now emerging as a possible means to meet ever‑changing needs. The following paper explores the way forward for sourcing, with buyers and suppliers adapting to grow their businesses for 2022 and beyond.

The insights presented draw upon both the findings of qualitative interview and quantitative survey research1 commissioned by Hong Kong Trade Development Council (HKTDC) and general observations from secondary sources (including media reports and research from outside sources) covering industry trends and forecasts.

New normal impacting sourcing

The changing preferences of both business customers and end‑consumers are continuing to impact the sourcing landscape. Buyers are striving to remain nimble enough to identify emerging trends that can influence upcoming orders. These trends include the demand for greater product variety, growing awareness of sustainability, and the desire for personalised and customised items. As these are poised to become more mainstream among consumers, these trends may end up compelling buyers to work with an extended network of suppliers to source new product offerings.

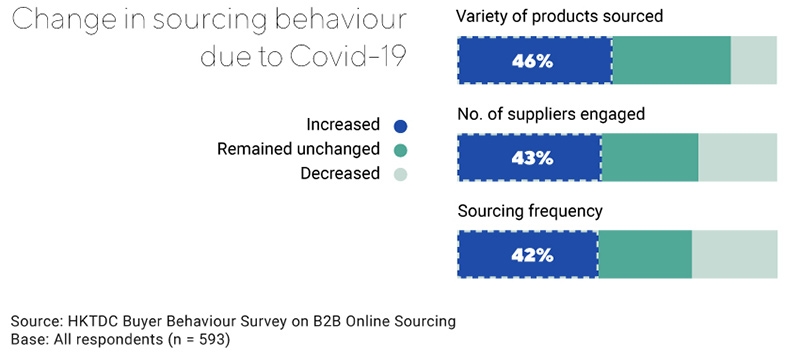

The desire for greater product variety is driving buyers to expand their networks

With physical fairs on hold, buyers are unable to meet with suppliers in person to better examine samples and get a feel for product trends. Meanwhile, end‑consumers continue to seek a greater variety of products. In order to meet this demand and generate new business, the HKTDC research shows that buyers are increasingly depending on online to search for new suppliers and products outside their regular established network. In the past year, 93% of surveyed buyers have used online sourcing platforms, and more than 40% of them are engaging more suppliers than they did prior to the pandemic. Nearly half of buyers said they are sourcing a wider variety of products to appease consumers, and one in three are sourcing orders more frequently with a higher average value.

Sustainability and ESG concerns trigger demand for eco-friendly products

As consumers are increasingly conscious of minimising environmental impacts and carbon footprints, buyers are more compelled to seek out products from suppliers that fit this profile. The HKTDC research found that increasing awareness of sustainability and ESG (environmental, social and governance standards) are materialising as key considerations for both business customers and end‑consumers in their product choices. With sustainability top‑of‑mind, innovative producers who utilise more environmentally friendly processes could very well stand to benefit.

“A trend for the past two years is the innovations in a sustainable direction. For final clients, especially in Europe, they are more conscious about the environment [and] about the impact of the co2 lifecycle. So that's why companies need to push [their] suppliers to innovate. Another trend of the sourcing also linked to this environmental conscious purchasing is to source from smaller companies that give us more environmentally friendly production.”

A buyer from the Home Products, Lights & Constructions category, Europe

Personalisation may be here to stay

Secondary research from a variety of sources shows that personalised items made according to a customer’s preferences are impacting buyer sourcing. Eschewing the “one‑size‑fits‑all” approach, personalisation enables brands to give their customers unique product experiences that are specially tailored to their needs and desires. Online sourcing platforms and suppliers may have to increasingly account for buyers’ needs to fulfil these customised orders that stand apart from general inventory. Although personalisation is not an entirely new concept, media reports suggest that personalisation is a factor to consider for brands in terms of both physical products and curated omnichannel experiences; Forbes notes that more than 50% of consumers2 have shown interest in purchasing personalised products for themselves and their friends and family, while AdAge reports that 60% of consumers3 are likely to become repeat buyers after a personalised experience.

“The orders from our customers are specific. We tailor-made their items. The reason why we don’t make purchases online is because we are looking for customised orders, not their inventory.”

A buyer from the Textile category, mainland China

Buyers’ evolving sourcing behaviour

During the pandemic era, the methods with which buyers carry out their job responsibilities have had to change significantly. Digital has become a necessary means as opposed to simply “nice‑to‑have”. Tasked with sourcing more diverse goods across a broader network, buyers and suppliers are now leaning on online sourcing platforms as a primary conduit. With all stages of the sourcing journey now taking place virtually, buyers are exercising due diligence to ensure they are working with the most trustworthy platforms and suppliers every step of the way.

The hunt for suppliers optimised for online sourcing

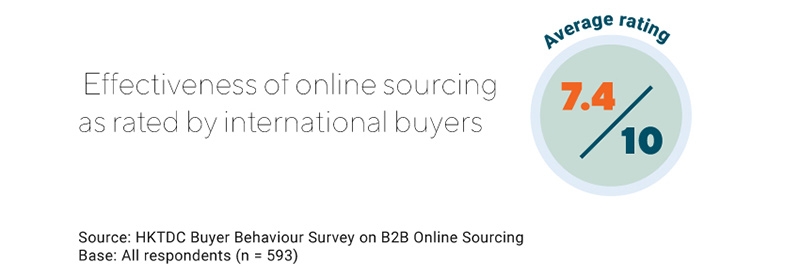

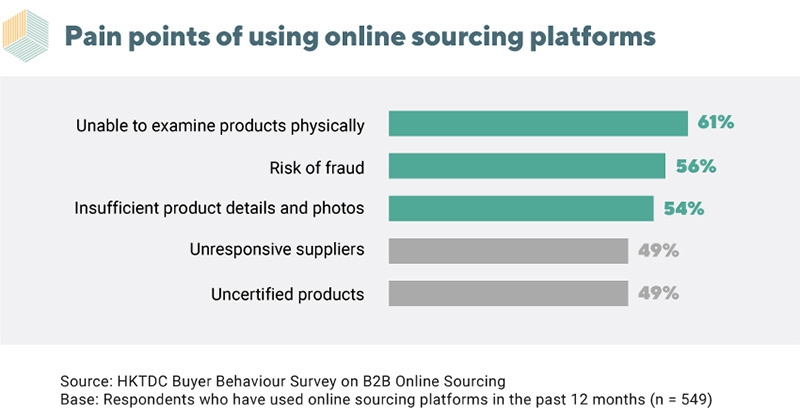

In their responses to the HKTDC survey research, buyers found online sourcing via web platforms, websites, mobile apps, and virtual meetings to be fairly effective overall. However, they are still finding online sourcing to be challenging at times, with the biggest issue being product and supplier authentication. Additional barriers that buyers mentioned included unresponsive suppliers and difficulty vetting products online.

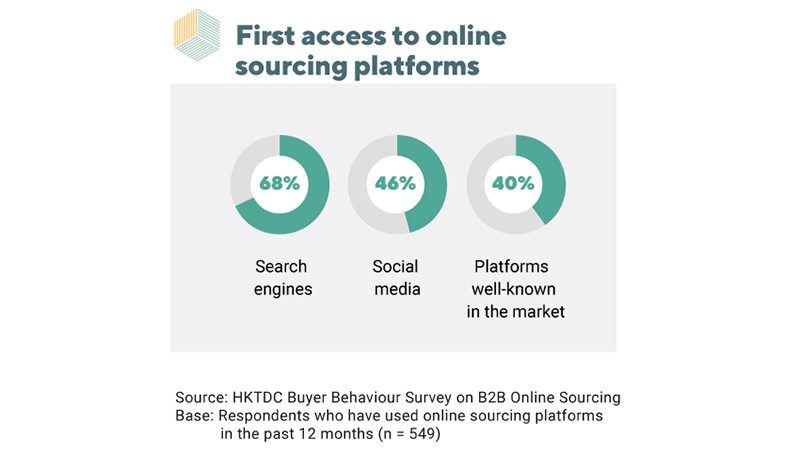

Online is key for research and discovery, such as product comparison and trendspotting

To further dig into how sourcing behaviour is taking place online, the HKTDC research surveyed international buyers on how they are using online sourcing platforms. Beyond making order enquiries, buyers are actively using online sourcing platforms to compare products and prices as well as observe new trends. As buyers broaden their horizons, search engines often generate the first visit to a new supplier, but social media is also playing more of a role during the research and discovery phase by connecting buyers with suppliers. Market reputation and referrals are also top considerations for the surveyed buyers when they engage new suppliers.

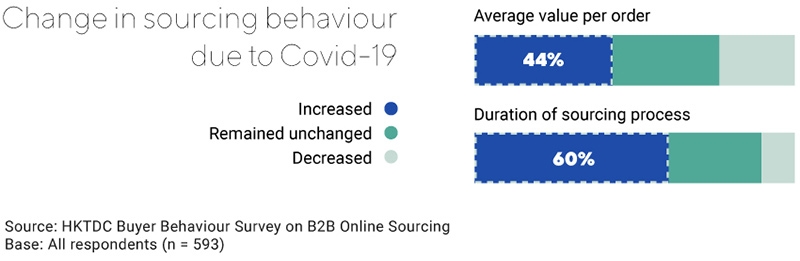

Maximising each shipment by increasing purchase size and value per order

According to the HKTDC survey research, 60% of buyers believe their sourcing process time has increased during the pandemic. Due to longer sourcing time and higher shipping costs, nearly half of buyers have increased their average value per order, with many opting to increase their purchase size per order. International news reports from outlets such as The New York Times4 suggest that high shipping costs and delays may continue for some time, a scenario likely to prompt buyers to seek the best ways to make the most of their transportation expenditure.

“We were paying something like $3,000 for a 20-foot container. And two weeks ago, we paid $9,000. And I think now it's even a lot more than that, from Shanghai to London.”

A buyer from the Healthcare category, Europe

The role of online sourcing platforms and virtual

As portals that generate business connections across international boundaries, the usage of online sourcing platforms has become standard practice for buyers and suppliers the world over, as is reflected in the HKTDC survey results. Enabling buyers to purchase a broad assortment of products, online sourcing platforms also facilitate key activities such as trendspotting and real‑time communications with suppliers. To progress this space, buyers in the HKTDC research said they would like to see online sourcing platforms that offer an expansive variety in verified suppliers and product assortment, ideally with fast response times.

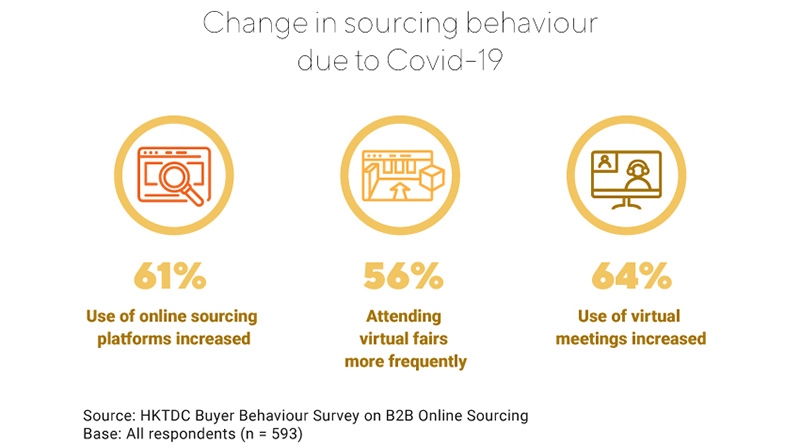

Leveraging online sourcing platforms, virtual meetings and fairs

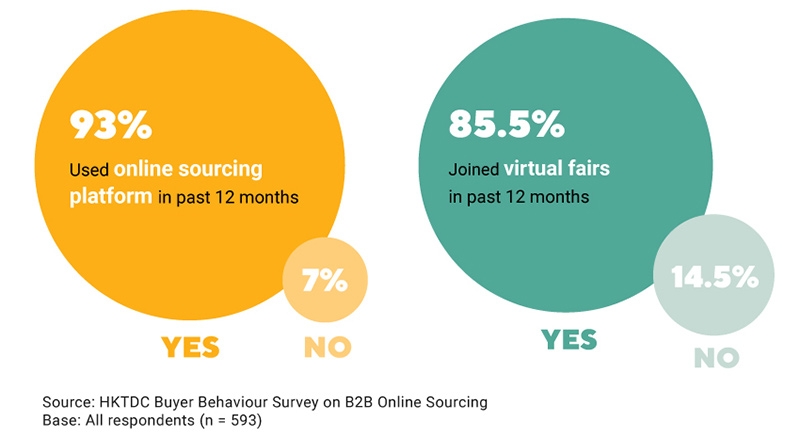

Major findings from the HKTDC research support the premise that digital tools for both buyers and suppliers have become an essential part of conducting business. The overwhelming majority of surveyed buyers (93%) used online sourcing platforms in the past year where they conducted an average of more than 60% of their sourcing. To overcome travel and social‑distancing restrictions and the subsequent absence of physical fairs, four out of five surveyed buyers also leveraged virtual meetings to fill the networking and communication gap. To further engage buyers and suppliers across boundaries, industries made significant efforts to offer virtual fairs. In doing so, they found a receptive audience, with more than 85% of surveyed buyers attending virtual fairs in 2021.

“Before Covid, there was no video conferences or small video conferences...nobody knew Zoom. Today, I have…two, three video conferences with my supplier [weekly]. So it [the number of video conferences has] really dramatically increased, as has the use of WeChat. All the factories, all the suppliers, they all know Zoom, TEAMS, all these different things.”

A buyer from the Home Products, Lights & Constructions category, Europe

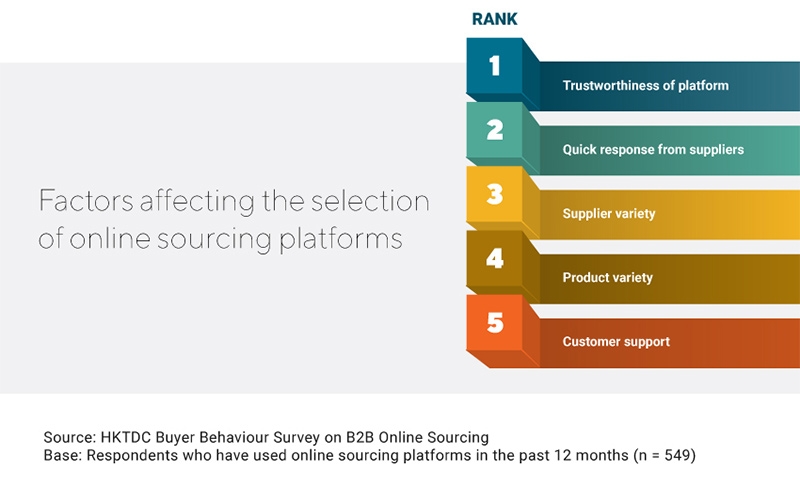

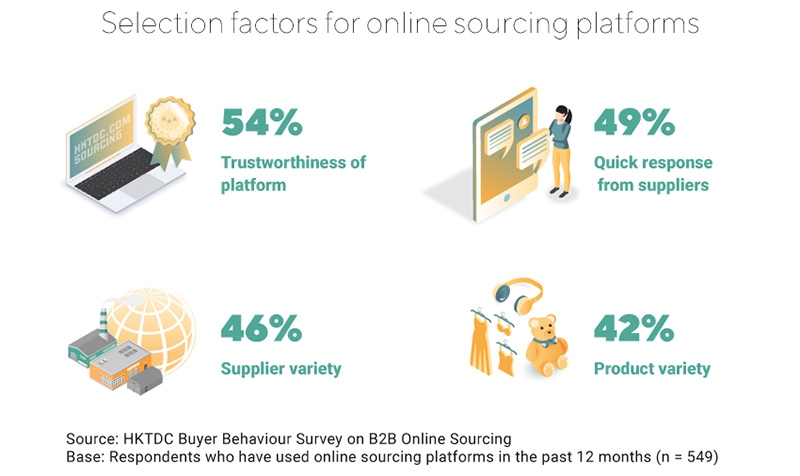

When choosing online sourcing platforms, trustworthiness is paramount

While buyers worldwide are increasingly going digital, ASEAN and mainland China buyers in particular are gravitating to online sourcing platforms, according to the HKTDC survey research. Among all regions, trustworthiness was heavily cited as the key criterion in selecting a platform. The buyers were also quick to point out that they greatly valued platforms that host a wide variety of suppliers, preferably ones that are highly responsive.

“I found it difficult to trust suppliers from online sourcing. The actual products received are different from the online pictures.”

A buyer from the Gifts, Toys & Sports Supplies category, UK

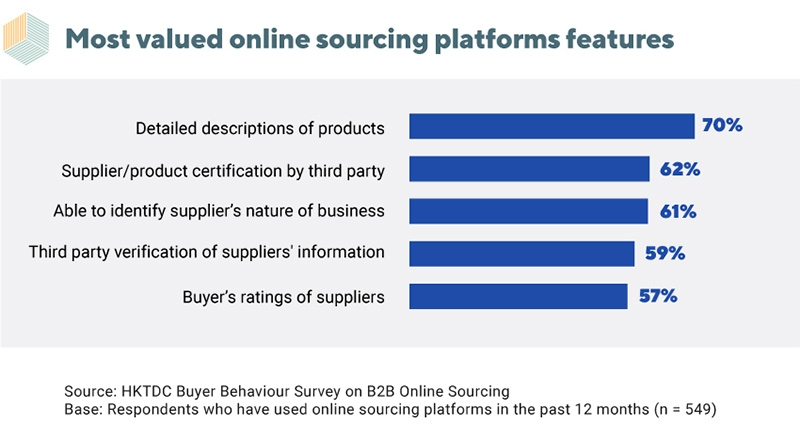

Encouraging suppliers to verify and contribute to platform credibility

A critical part of building a trustworthy online platform is ensuring all parties are vetted, and the HKTDC research reflects this as features associated with credibility are highly in demand among buyers. The surveyed buyers made clear in their rankings that they appreciate readily displayed supplier credentials (such as verified third‑party certifications) to establish credibility, clearly stated nature of business, quick and timely responses to enquiries, as well as online payment and logistics. Detailed descriptions of products was the most valued feature as they help buyers determine credibility.

How supplier can meet buyers’ needs

Suppliers may be able to build solid relationships with buyers by conducting business on trusted and reliable sourcing platforms. They can also establish their credibility among buyers by sharing certifications and endorsements. To better engage buyers through an O2O journey, suppliers can also look to acquire knowledge of digitalisation to narrow existing knowledge gaps and enhance service.

Maximising reach with multi-channel touchpoints

While search engine keyword optimisation, search engine marketing, and website development are foundational parts of digital readiness, suppliers have many avenues of growth to explore online. The most digitally savvy suppliers are proactively generating new business leads and extending their reach to potential buyers by engaging them via online sourcing platforms, virtual fairs and social media.

“Before the pandemic, I never received any random messages, messaging me if I needed supplies. Now I see that all the time from LinkedIn, Instagram or email.”

A buyer from the Jewellery category, UK

Sufficient product presentation and information a must

After ensuring new buyers can easily connect with them online, it is critical for suppliers to gain their trust to convert business opportunities. On online sourcing platforms, suppliers would be well‑served by prioritising product variety and optimal presentation to meet buyer expectations. Potential buyers seek as much information as possible to assuage their concerns surrounding fraud, which means providing in‑depth product details, and sufficient supporting media (product photos and/or video demos etc.) should be a top consideration for suppliers.

“Once we see something interesting, we would request samples and quotes. If we liked the samples and found no problems with the speed and accuracy of their response to our messages, we would then proceed to the next step.”

A buyer from the Fashion, Clothing & Accessories category, mainland China

Enhance O2O engagement by addressing digital knowledge gaps

With virtual fairs and the digital showcases presenting opportunities to extend reach, suppliers can explore different ways to build digital capabilities. In fact, just 38% of buyers in the survey perceived that most suppliers are ready and capable for digital sourcing.

Hybrid fairs to lead to the future of sourcing

Close to 90% of buyers in the HKTDC research have attended virtual fairs during the pandemic. While international buyers have accepted this format out of necessity, the general consensus remains that virtual fairs will not supersede physical fairs as they are not perfect substitutes.

Virtual fairs cannot provide buyers with the physical ability to examine and evaluate products physically through touch and feel, while physical fairs do not offer the always‑on convenience that only digital can provide.

“The virtual fair was quite complicated because the problem is that for the material, you have to touch it. Whereas for the colour it is not a problem, you can see if you like the colour. For a mixture of materials, for example, a mix of cotton with spandex and metallic fibre. If you don’t touch it, you don’t know how it feels.”

A buyer from the Stationery category, France

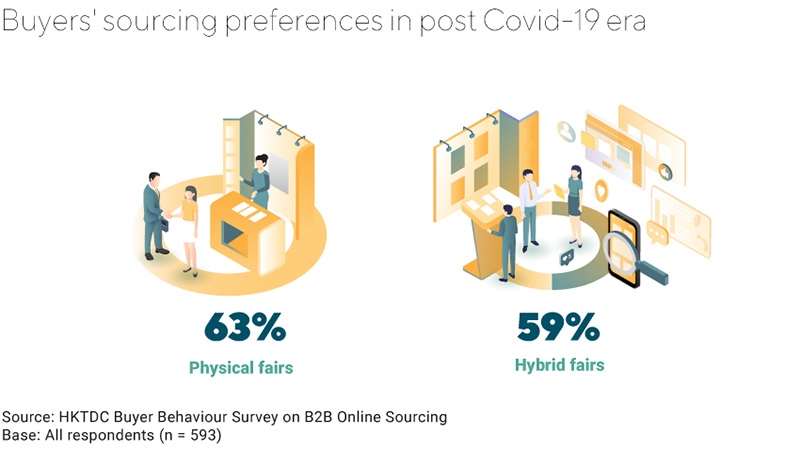

Perhaps by seeing physical and virtual as supplements to one another, most surveyed international buyers stated they would prefer to source via physical fairs or hybrid fairs once travel restrictions are lifted.

So what exactly is the new hybrid fair model and what should it entail looking ahead?

How hybrid fairs optimise the physical with virtual integrations

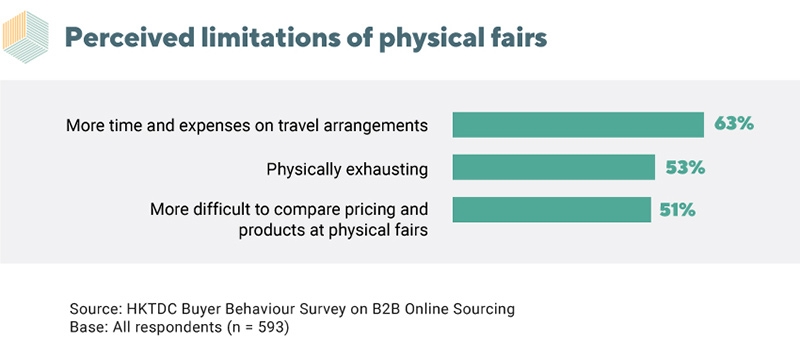

Hybrid fairs are designed to enhance the physical fair experience by integrating digital tools and elements of virtual fairs. Firstly, the digital capabilities of hybrid fairs can address the major pain points of physical fairs that buyers experience. These include considerable travel time and expense, physical exhaustion incurred from traversing large tradeshow venues, and significant difficulties in physically comparing pricing and products quickly and efficiently.

“We have found that more of our staff can go to the virtual trade shows. The additional attendees incurred minimal costs. We will tell our staff that there is a conference that you can attend because it is virtual, it is up to staff to decide whether they would like to attend. By comparison, going to a physical conference costs lots of money – you have to pay for flights and accommodation. Hotels are very expensive when there is a trade show because so many people are trying to book at the same time.”

A buyer from the Healthcare category, UK

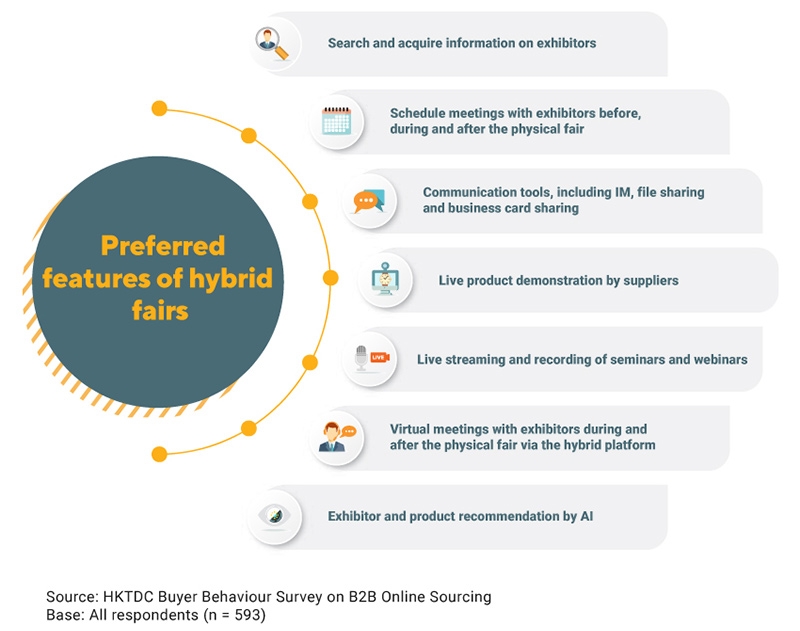

Digital features that enhance the buyer journey

Key digital features that surveyed buyers would like to see at hybrid fairs are the abilities to easily search and acquire exhibitor information, schedule meetings with exhibitors (both before, during and after the physical fair), and useful communication tools such as instant messaging, file sharing and business card sharing. Live product demonstrations, seminar livestreaming and recordings and virtual meetings, as well as AI‑enabled exhibitor and product recommendations, are also sought‑after features that offer meaningful benefits to all parties.

Emerging trends in hybrid fairs to note for suppliers

With nearly 60% of international buyers preferring to source via hybrid fairs once travel restrictions are lifted, mainland Chinese and ASEAN buyers are the most enthusiastic adopters of hybrid fair models, followed by European, American and Australian buyers. The HKTDC survey research also showed that buyers who prefer hybrid fairs were more likely to register a higher average spend per order (from at least US$50,000‑$100,000+) compared with counterparts who prefer physical or virtual fairs. This could suggest that hybrid fairs may be positioned to facilitate more lucrative business opportunities.

“I would like to visit virtual trade shows, and add parts of the physical one as well – but use the virtual one first to narrow a lot of the companies down and then you get the best of both worlds. So you will get the really good ones online, and also physical ones as well. There are no geographical constraints, and it allows buyers to participate anytime and anywhere.”

A buyer from the Healthcare category, UK

1 During the period May‑October 2021, Ipsos Strategy3 was commissioned by the HKTDC to conduct 26 qualitative in‑depth interviews and an online quantitative survey of 593 international buyers–of which 568 were from the ASEAN bloc, Australia, Europe, mainland China and the US.

2 “The Future of SMB Retail: Custom And Personalized Products”, Forbes, February 2021

3 “Why Brands Must Embrace Personalization Before It’s Too Late”, AdAge, June 2021

4 “‘I’ve Never Seen Anything Like This’: Chaos Strikes Global Shipping”, The New York Times, October 2021